I think the single most important development in the last century is the widespread and nearly instant access to news, entertainment, and information from throughout the world. Television started it, cable TV advanced it, and the Internet strapped a rocket to its butt and lit the fuse. One odd little consequence of media proliferation is the selection of stories. Coupled with vast population increases, information sharing has changed drastically.

A hundred years ago, a person in a small town got most of their local news over the fence (gossip), and got their business/politics news from the papers. The proportion of stories would be fairly similar to the proportion of events that impacted a community (albeit with a slight emphasis on scandal and a bit of inaccuracy in gossip). So if one house was burglarized, the average person heard about one house being burglarized. If a house in another town was burglarized, that burglary would be reported in their local news. When I was growing up in the 1970s, parents worried about their children being stolen. Was it because child disappearances were an epidemic? No. It was because child disappearances seemed like an epidemic when every news-watching person in every town in America heard about virtually all of the (still rare) child disappearances happening throughout the country. Television made all news feel local.

Then you throw population increases into the mix, and the world feels mighty dangerous, indeed. Even if child disappearances held steady at (I'm totally making this number up out of thin air) 1 per 10,000 population, every time the population doubled, that would mean that the number of cases doubled. In 1930, our population was less than 3 million; today, it is over 300 million. That's 100 times more people. If long-term trends continued unchanged, that should represent 100 times more crimes, 100 times more illnesses, 100 times more divorces, 100 times more marriages and church picnics and everything else that is, generally, proportional to population.

Our perception of risk has jumped off the deep end. Some kid shoots himself while playing with grandpa's gun and the story is different through the TV lens. A hundred years ago, if you heard over the fence that little Johnny shot himself accidentally, you knew little Johnny and you knew he was an idiot. Now, you hear about it on TV and the reporter doesn't mention that little Johnny is an idiot, and a lot of people respond with "we need a law to keep that from happening to my kid!" Pretty soon, we have a lot of laws to protect normal kids from abnormal risks, and we get into a legal game of one-upmanship. "By golly, if it's illegal to talk on a cell phone while driving, it out to be illegal to ____ [fill in the blank]. That's WAY more dangerous!"

Perspective has been completely destroyed. Our brains have to filter out information just to survive (imagine if you couldn't ignore all of the conversations at other tables in a restaurant), and we alternately filter out anything that affects "the rich," "the poor," "minorities," "majorities" and various groups we aren't in, we filter out anything affecting an irrelevant number of people (only 1,000 dead? that's not news), and then we filter in anything intolerable-but-possible (children dying? I couldn't stand to have my child die!).

Maybe every newscast should end with a shot of perspective. "20 people have been diagnosed with the possible killer flu. In other news, 299,999,935 Americans probably don't have killer flu. 299,999,600 Americans have not been kidnapped, and 140,000,000 Americans did not pay any Federal income tax this year. 298 Million Americans have not been killed or seriously injured in an industrial accident, while 400,000 Americans have been laid-off as their jobs shipped to nations that do not try to outlaw every possible danger. Thank you, and Good night."

Wednesday, April 29, 2009

Friday, April 24, 2009

Remodeling: Contractor Progress Payments

We've run into a bit of a problem with our contractor. It seems that, despite us telling him many times that we want everything done to code and we want all necessary permits, he doesn't like to pull permits. His contract - his boilerplate contract, not ours - says that he will handle all the permits and all the permit costs. So he called us the day before beginning work and asked if we wanted a permit for the job. Of course we do. Say what you will about the government's right to control construction of our house, we feel that the prudent thing for us to do is to comply with the applicable laws. If the law says we need a permit, we want a permit.

So the contractor demanded the permit fees. We pointed out that the contract says the fees are included, and that we agreed on a price in the belief that, as the contract says, permit fees are included. Consequently, the contractor feels aggrieved and has been difficult to work with. If I knew a week ago what I know now, I would have hired someone else. And I'm all the more peeved because we selected the contractor who presented the best quality quote, not the lowest price. In the process of dealing with the "forgotten" permit, the contractor breached our trust. His subsequent attempts to cut corners on the job have further damaged our respect for him.

Today we made another progress payment. We have a big mess, bare wall studs, exposed wiring, partial plumbing, a hole in the floor. Our contractor now has 65% of the contract cost in his pocket. I'm feeling a bit nervous. I made a mistake in agreeing to front-load the progress payments so much. For example, we made a large payment upon completion of framing, not realizing that framing is basically the first task. Now, the job is perhaps 30% complete, while the payments are 65% complete. I have no reason to believe that the subcontractors have been paid; if the contractor doesn't pay them, Mechanics Lien law allows the subcontractors to sue us for their fee (even though we have already paid their fee to the General Contractor), and to place a lien against the house if we refuse to pay. If the contractor quit now, he would have a legal obligation to refund us the excess payments, but we would have the burden of recouping that money from him - not an ideal position to be in when local contractors are going bankrupt.

In the future, I will make sure that we have a more detailed definition of what work shall be complete before a progress payment is due. I will also make sure that the payments are slightly back-loaded; the contractor will have to finish the job to receive payment in full for the work.

I also discovered a neat little website. In Sacramento County, you can look up building permits by contractor name, company name, job site address, etc. So next time I hire a contractor, I will look up his/her permits before I interview him or her. If he/she has not pulled a substantial number of contracts, I will ask why. And when I buy a house, I will search for permits issued to that address. If there are no permits and the house has obviously-new items that require a permit, I would rather know that before I buy than after.

So the contractor demanded the permit fees. We pointed out that the contract says the fees are included, and that we agreed on a price in the belief that, as the contract says, permit fees are included. Consequently, the contractor feels aggrieved and has been difficult to work with. If I knew a week ago what I know now, I would have hired someone else. And I'm all the more peeved because we selected the contractor who presented the best quality quote, not the lowest price. In the process of dealing with the "forgotten" permit, the contractor breached our trust. His subsequent attempts to cut corners on the job have further damaged our respect for him.

Today we made another progress payment. We have a big mess, bare wall studs, exposed wiring, partial plumbing, a hole in the floor. Our contractor now has 65% of the contract cost in his pocket. I'm feeling a bit nervous. I made a mistake in agreeing to front-load the progress payments so much. For example, we made a large payment upon completion of framing, not realizing that framing is basically the first task. Now, the job is perhaps 30% complete, while the payments are 65% complete. I have no reason to believe that the subcontractors have been paid; if the contractor doesn't pay them, Mechanics Lien law allows the subcontractors to sue us for their fee (even though we have already paid their fee to the General Contractor), and to place a lien against the house if we refuse to pay. If the contractor quit now, he would have a legal obligation to refund us the excess payments, but we would have the burden of recouping that money from him - not an ideal position to be in when local contractors are going bankrupt.

In the future, I will make sure that we have a more detailed definition of what work shall be complete before a progress payment is due. I will also make sure that the payments are slightly back-loaded; the contractor will have to finish the job to receive payment in full for the work.

I also discovered a neat little website. In Sacramento County, you can look up building permits by contractor name, company name, job site address, etc. So next time I hire a contractor, I will look up his/her permits before I interview him or her. If he/she has not pulled a substantial number of contracts, I will ask why. And when I buy a house, I will search for permits issued to that address. If there are no permits and the house has obviously-new items that require a permit, I would rather know that before I buy than after.

Wednesday, April 15, 2009

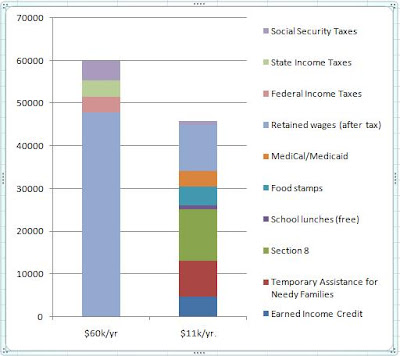

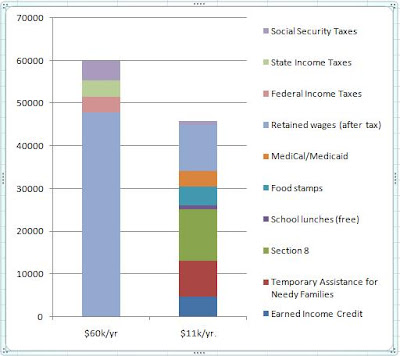

Is it better to earn $11k/year or $60k/year?

The Sacramento Bee has an interesting graphic depicting how long it takes various people to earn $100,000. They show a single waitress at the bottom of the heap, the poor woman takes 7 years to earn $100k. But that doesn't tell the whole story.

A family of three, headed by a single parent, earning $11,700/year gets much more than $11k/year's worth of standard of living.

The family qualifies for a Section 8 housing assistance, worth over $12,000/year.

The parent qualifies for the Earned Income Credit, worth $4,710/year.

Temporary Assistance for Needy Families gives them $8,448/year.

They get Food stamps worth $372/month, or $4,464/year.

The qualify for free school lunches, worth $2.57 each, or about $925/year.

They qualify for MediCal/Medicaid worth, conservatively, $300/month or $3,600/year.

They don't pay a penny in taxes. They contribute 8%, $941/year, towards Social Security.

Equivalent Net disposable income? $45,900. With welfare benefits, the needy family has about the same standard of living as a family earning $50k a year.

Contrast that with an accountant earning $60,000 a year to support a family of 3. The accountant will pay about $3,800 in California state taxes, and about $3,600 in Federal taxes, and $4,600 towards social security.

Net income after taxes: $47,900.

For all the years spent in college, all of the job stress, all of the work and planning that went into having a decent middle-class job, the accountant has just $4,000 more disposable income than the welfare family has. Meanwhile, the accountant has to worry about job security; the needy family has financial security because they will still have food and housing even if they lose their job.

The accountant takes work home with him/her, reads accounting journals, studies up on changes to the tax code. The job has a lot of responsibilities that spill over outside work hours. The accountant is a salaried employee, with no compensation for overtime. If you divide the disposable income by hours worked, the accountant actually has a lower net hourly wage than the "needy" parent has.

What is wrong with this picture?

The chart shows the income of a single parent with 2 children, earning $60,000 a year. The long periwinkle blue bar is the income the family keeps after taxes, the three small bars on top are state and federal income tax and social security/FICA withholdings.

The bar on the right represents a single-parent household with 2 children, earning $11,772 in wages. The blue bar near the top is social security withholdings, which is the only income tax the parent pays. The periwinkle blue bar second from top is wages. The multiple bars below wages show how much government subsidies raise the family's effective income.

Edit: Added the bar chart.

A family of three, headed by a single parent, earning $11,700/year gets much more than $11k/year's worth of standard of living.

The family qualifies for a Section 8 housing assistance, worth over $12,000/year.

The parent qualifies for the Earned Income Credit, worth $4,710/year.

Temporary Assistance for Needy Families gives them $8,448/year.

They get Food stamps worth $372/month, or $4,464/year.

The qualify for free school lunches, worth $2.57 each, or about $925/year.

They qualify for MediCal/Medicaid worth, conservatively, $300/month or $3,600/year.

They don't pay a penny in taxes. They contribute 8%, $941/year, towards Social Security.

Equivalent Net disposable income? $45,900. With welfare benefits, the needy family has about the same standard of living as a family earning $50k a year.

Contrast that with an accountant earning $60,000 a year to support a family of 3. The accountant will pay about $3,800 in California state taxes, and about $3,600 in Federal taxes, and $4,600 towards social security.

Net income after taxes: $47,900.

For all the years spent in college, all of the job stress, all of the work and planning that went into having a decent middle-class job, the accountant has just $4,000 more disposable income than the welfare family has. Meanwhile, the accountant has to worry about job security; the needy family has financial security because they will still have food and housing even if they lose their job.

The accountant takes work home with him/her, reads accounting journals, studies up on changes to the tax code. The job has a lot of responsibilities that spill over outside work hours. The accountant is a salaried employee, with no compensation for overtime. If you divide the disposable income by hours worked, the accountant actually has a lower net hourly wage than the "needy" parent has.

What is wrong with this picture?

The chart shows the income of a single parent with 2 children, earning $60,000 a year. The long periwinkle blue bar is the income the family keeps after taxes, the three small bars on top are state and federal income tax and social security/FICA withholdings.

The bar on the right represents a single-parent household with 2 children, earning $11,772 in wages. The blue bar near the top is social security withholdings, which is the only income tax the parent pays. The periwinkle blue bar second from top is wages. The multiple bars below wages show how much government subsidies raise the family's effective income.

Edit: Added the bar chart.

Friday, April 03, 2009

Everybody's talking about a bottom in real estate

"Of all mortgages covered, at year-end slightly more than 10 percent were nonperforming, meaning behind on payments, compared to about 7 percent nonperforming in September. "

From: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/04/03/BUU716RR4Q.DTL

Article is a good read, with some nifty graphics.

Here in the Sacramento area, I've seen homes listed as short sales for a very long time at unreasonable prices. I made an offer on one, an incredibly risky all-cash offer, and the bank didn't accept it. The house is now in the process of foreclosure, and I would not offer the same price for it today (the market has fallen since then, and the house has had a full year of not being maintained). Generally, when a house goes from short sale to foreclosure, the bank drops the price to a reasonable price, sometimes even a fabulous price. Sometimes, although it's rare, we see short sales at reasonable prices. Why are some so incredibly over-priced that they cannot sell, while others are priced almost as low as foreclosure prices?

It appears that the banks are only willing to be reasonable on short sales if the buyer stops making payments. As long as the buyer is paying, the bank will insist on an unreasonably high price. I base this observation on another observation - over-priced short sales sit on the market for a long time, some go well over a year, which suggests that the borrower is continuing to pay (otherwise the banks would have foreclosed). Well-priced short sales, if they do not sell as short sales, come back on the market rather quickly as foreclosures, which suggests that they were in foreclosure (not making payments) while listed as short sales.

So some of the increase in "seriously delinquent" mortgages may actually be a sign of buyers catching on to the bank's tricks, rather than an indication of increasing illiquidity. Still, the fact that serious delinquencies are increasing even as the government hands out free loan modifications, coupled with the overhang of inventory that is not presently on the market, suggests that the bottom may not yet be here. The article says that 10% of all mortgages are non-performing; when you think about the fact that many, many people have less than 10 years remaining on their mortgages, many people bought their homes in the 1980's for less than $30,000, a whole lot of people owe very little on their homes, 10% of all mortgages is a LOT. Then again, at least in Sacramento, there are homes priced so low that they cash flow even at very low rent assumptions, even if expenses are rather high (like if the owner hires a property manager). So, bottom, top, I don't know, but caution is still warranted. Not inaction, not abject terror, but caution. As I look to buy, I keep reminding myself of the old saw, "markets can stay irrational longer than you can stay liquid."

From: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/04/03/BUU716RR4Q.DTL

Article is a good read, with some nifty graphics.

Here in the Sacramento area, I've seen homes listed as short sales for a very long time at unreasonable prices. I made an offer on one, an incredibly risky all-cash offer, and the bank didn't accept it. The house is now in the process of foreclosure, and I would not offer the same price for it today (the market has fallen since then, and the house has had a full year of not being maintained). Generally, when a house goes from short sale to foreclosure, the bank drops the price to a reasonable price, sometimes even a fabulous price. Sometimes, although it's rare, we see short sales at reasonable prices. Why are some so incredibly over-priced that they cannot sell, while others are priced almost as low as foreclosure prices?

It appears that the banks are only willing to be reasonable on short sales if the buyer stops making payments. As long as the buyer is paying, the bank will insist on an unreasonably high price. I base this observation on another observation - over-priced short sales sit on the market for a long time, some go well over a year, which suggests that the borrower is continuing to pay (otherwise the banks would have foreclosed). Well-priced short sales, if they do not sell as short sales, come back on the market rather quickly as foreclosures, which suggests that they were in foreclosure (not making payments) while listed as short sales.

So some of the increase in "seriously delinquent" mortgages may actually be a sign of buyers catching on to the bank's tricks, rather than an indication of increasing illiquidity. Still, the fact that serious delinquencies are increasing even as the government hands out free loan modifications, coupled with the overhang of inventory that is not presently on the market, suggests that the bottom may not yet be here. The article says that 10% of all mortgages are non-performing; when you think about the fact that many, many people have less than 10 years remaining on their mortgages, many people bought their homes in the 1980's for less than $30,000, a whole lot of people owe very little on their homes, 10% of all mortgages is a LOT. Then again, at least in Sacramento, there are homes priced so low that they cash flow even at very low rent assumptions, even if expenses are rather high (like if the owner hires a property manager). So, bottom, top, I don't know, but caution is still warranted. Not inaction, not abject terror, but caution. As I look to buy, I keep reminding myself of the old saw, "markets can stay irrational longer than you can stay liquid."

Subscribe to:

Posts (Atom)