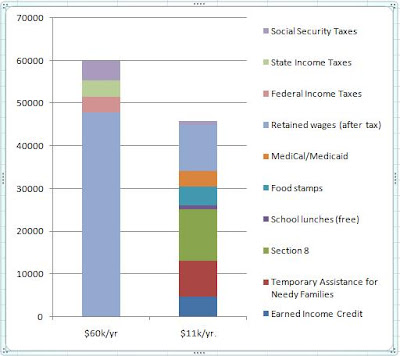

A family of three, headed by a single parent, earning $11,700/year gets much more than $11k/year's worth of standard of living.

The family qualifies for a Section 8 housing assistance, worth over $12,000/year.

The parent qualifies for the Earned Income Credit, worth $4,710/year.

Temporary Assistance for Needy Families gives them $8,448/year.

They get Food stamps worth $372/month, or $4,464/year.

The qualify for free school lunches, worth $2.57 each, or about $925/year.

They qualify for MediCal/Medicaid worth, conservatively, $300/month or $3,600/year.

They don't pay a penny in taxes. They contribute 8%, $941/year, towards Social Security.

Equivalent Net disposable income? $45,900. With welfare benefits, the needy family has about the same standard of living as a family earning $50k a year.

Contrast that with an accountant earning $60,000 a year to support a family of 3. The accountant will pay about $3,800 in California state taxes, and about $3,600 in Federal taxes, and $4,600 towards social security.

Net income after taxes: $47,900.

For all the years spent in college, all of the job stress, all of the work and planning that went into having a decent middle-class job, the accountant has just $4,000 more disposable income than the welfare family has. Meanwhile, the accountant has to worry about job security; the needy family has financial security because they will still have food and housing even if they lose their job.

The accountant takes work home with him/her, reads accounting journals, studies up on changes to the tax code. The job has a lot of responsibilities that spill over outside work hours. The accountant is a salaried employee, with no compensation for overtime. If you divide the disposable income by hours worked, the accountant actually has a lower net hourly wage than the "needy" parent has.

What is wrong with this picture?

The chart shows the income of a single parent with 2 children, earning $60,000 a year. The long periwinkle blue bar is the income the family keeps after taxes, the three small bars on top are state and federal income tax and social security/FICA withholdings.

The bar on the right represents a single-parent household with 2 children, earning $11,772 in wages. The blue bar near the top is social security withholdings, which is the only income tax the parent pays. The periwinkle blue bar second from top is wages. The multiple bars below wages show how much government subsidies raise the family's effective income.

Edit: Added the bar chart.

4 comments:

Non sequitur, or spam? When a comment is illogical/irrelevant and is repeated, word for word, on 20 other blog sites, I'm gonna call it spam. But it did lead me to a blog post with an interesting turn of phrase: bankster. Thanks.

Excellent. Perahps you should do the figures as a stacked column graph.

Sackerson,

Thank you for an excellent suggestion. I have added a graph.

Post a Comment