Friday, November 13, 2009

Do you have an emergency budget plan?

life-on-severance-comfort-then-crisis.html: Personal Finance News from Yahoo! Finance: "Although their rent was cheaper, Mr. Hipsher says the family continued to spend like before. They moved with three cars -- two BMWs and a Chevy Silverado. They continued to buy cases of $36-a-bottle wine. They spent $250 a month on a cleaning lady, and Mr. Hipsher dropped $50 a week on flowers for his wife. The couple still dined out regularly."

The article talks about families burning through severance and savings and finding themselves out of cash and still unemployed. Most of the families started out as prodigious spenders and continued to spend lavishly when the $100k+ jobs disappeared; one family had pretty modest tastes (relative to income) and is still worrying.

When the economy started to turn sour, my family put together a budget that we call "survival mode." We already had a budget for buying a house, which we converted into a budget/spending plan for our day-to-day spending before buying a house. Survival mode took a while to put together - we took our existing budget and slashed, slashed, slashed. We didn't slash to the bone. We kept Internet access - although we downgraded to dial-up. We kept in mind that unemployment and severance incomes are taxable, and we budgeted for taxes. We tried to be realistic about what expenditures brought a lot of happiness, a sense of normalcy, or were very important (health insurance, for example). Still, it took a lot of soul-searching to decide which spending categories really matter and which are luxuries that we can live without.

Two things happened. One, we converted the vague anxiety about possible loss of income into the security of having a plan to survive. This is important - having a plan already in place means that we can activate plan B if we lose our income - rather than absorbing the loss of income while also frantically cutting expenses, or, as the people in the article did, continuing to spend until the money runs out. Two, we had some really good conversations about what is important. We made some of the "survival mode" cuts right away. Cable TV, for example, didn't rank high on our priorities. It was nice-to-have, but then the cable company raised rates and we realized that we just didn't get that much enjoyment out of it. So we cut cable. That freed up money for increasing savings. We also realized that the $60,000 severance that the couple in the article received, doesn't go very far when housing costs $24,000 a year (and taxes eat up a big chunk of severance money, too).

When lay-offs got too close to home, we reminded each other "it wouldn't be the end of the world. It would suck, but we would survive." We would trot out the survival-mode budget and say "look, we'd still have money for networking lunches and a nice dinner in." When stress ran high, we would remind each other than we can make it. So instead of wasting energy on worry, we could focus on moving forward. We can be strategic. We can still contemplate buying a house (although we are being cautious and we would not consider spending 40% of income on a house right now. I think that a house with room for a garden and zoning that allows chickens or sheep, would actually be a benefit if times got tough - although having a renter's freedom to move on a moment's notice has its benefits, too).

We tried to be realistic - we didn't say that we will live on library books and rice and beans, we left some money in the budget for sanity and a sense of still having choices. We kept the "lunches at work" category for networking lunches; we kept (downsized) charitable contributions and gifts. We kept health insurance, life insurance, car insurance and homeowners' insurance. We kept the budget category for healthcare co-pays. We cut groceries a bit. If things went really badly, there is more room to cut back.

Having a plan is an optimistic choice. We know we can survive on less than we earn (though, naturally, we'd prefer to increase our income). We don't have to stick our heads in the sand and say "it's too horrible to contemplate!" And we know that we need to beef up our savings if we want to have the security to stay reasonably comfortable in a financial crisis that can leave well-qualified workers out of work for over year. It is far better to realize that while money is still coming in, than to realize it after the money has run out, as so many of the people in the article did.

Families can pull together and get through anything. It's a family effort, and it helps to remind the family about the benefits of cutting back to save more, or cutting back to outlast a crisis. The fellow in the article spending $250/month on a cleaning lady ($3,000 a year) after losing his job - I bet his wife would rather have $3,000 in the bank now. It is definitely hard to adapt to a major reduction in income, but writing a what-if budget helps you prepare mentally, and if things go awfully wrong, it lets you put the austerity budget on auto-pilot while you grieve for the job, security, and lifestyle lost and get to work moving on. Give your family the gift of peace of mind. Work on building a 6-12 month emergency fund. If you need it, you will find that it is worth far more than memories of watching cable TV, eating out every week, or having a professionally cleaned home.

The article talks about families burning through severance and savings and finding themselves out of cash and still unemployed. Most of the families started out as prodigious spenders and continued to spend lavishly when the $100k+ jobs disappeared; one family had pretty modest tastes (relative to income) and is still worrying.

When the economy started to turn sour, my family put together a budget that we call "survival mode." We already had a budget for buying a house, which we converted into a budget/spending plan for our day-to-day spending before buying a house. Survival mode took a while to put together - we took our existing budget and slashed, slashed, slashed. We didn't slash to the bone. We kept Internet access - although we downgraded to dial-up. We kept in mind that unemployment and severance incomes are taxable, and we budgeted for taxes. We tried to be realistic about what expenditures brought a lot of happiness, a sense of normalcy, or were very important (health insurance, for example). Still, it took a lot of soul-searching to decide which spending categories really matter and which are luxuries that we can live without.

Two things happened. One, we converted the vague anxiety about possible loss of income into the security of having a plan to survive. This is important - having a plan already in place means that we can activate plan B if we lose our income - rather than absorbing the loss of income while also frantically cutting expenses, or, as the people in the article did, continuing to spend until the money runs out. Two, we had some really good conversations about what is important. We made some of the "survival mode" cuts right away. Cable TV, for example, didn't rank high on our priorities. It was nice-to-have, but then the cable company raised rates and we realized that we just didn't get that much enjoyment out of it. So we cut cable. That freed up money for increasing savings. We also realized that the $60,000 severance that the couple in the article received, doesn't go very far when housing costs $24,000 a year (and taxes eat up a big chunk of severance money, too).

When lay-offs got too close to home, we reminded each other "it wouldn't be the end of the world. It would suck, but we would survive." We would trot out the survival-mode budget and say "look, we'd still have money for networking lunches and a nice dinner in." When stress ran high, we would remind each other than we can make it. So instead of wasting energy on worry, we could focus on moving forward. We can be strategic. We can still contemplate buying a house (although we are being cautious and we would not consider spending 40% of income on a house right now. I think that a house with room for a garden and zoning that allows chickens or sheep, would actually be a benefit if times got tough - although having a renter's freedom to move on a moment's notice has its benefits, too).

We tried to be realistic - we didn't say that we will live on library books and rice and beans, we left some money in the budget for sanity and a sense of still having choices. We kept the "lunches at work" category for networking lunches; we kept (downsized) charitable contributions and gifts. We kept health insurance, life insurance, car insurance and homeowners' insurance. We kept the budget category for healthcare co-pays. We cut groceries a bit. If things went really badly, there is more room to cut back.

Having a plan is an optimistic choice. We know we can survive on less than we earn (though, naturally, we'd prefer to increase our income). We don't have to stick our heads in the sand and say "it's too horrible to contemplate!" And we know that we need to beef up our savings if we want to have the security to stay reasonably comfortable in a financial crisis that can leave well-qualified workers out of work for over year. It is far better to realize that while money is still coming in, than to realize it after the money has run out, as so many of the people in the article did.

Families can pull together and get through anything. It's a family effort, and it helps to remind the family about the benefits of cutting back to save more, or cutting back to outlast a crisis. The fellow in the article spending $250/month on a cleaning lady ($3,000 a year) after losing his job - I bet his wife would rather have $3,000 in the bank now. It is definitely hard to adapt to a major reduction in income, but writing a what-if budget helps you prepare mentally, and if things go awfully wrong, it lets you put the austerity budget on auto-pilot while you grieve for the job, security, and lifestyle lost and get to work moving on. Give your family the gift of peace of mind. Work on building a 6-12 month emergency fund. If you need it, you will find that it is worth far more than memories of watching cable TV, eating out every week, or having a professionally cleaned home.

Tuesday, November 10, 2009

Universal healthcare: the Rationing myth

Socialized medicine was rolled out in countries that had not developed the entrenched commercial medical system America has. "Free" health insurance in socialist countries was better than being uninsured, and few people had been privately insured long enough to develop entrenched expectations.

America is different. We all have government health insurance - emergency room care might ruin your credit, but you can use it if you have to. Medicaid (for the poor) helps the very poor - and if someone gets very, very sick, they become poor enough to qualify as soon as they're too disabled to work. Medicare (for the elderly) covers everybody during those critically expensive senior years. Most of us have private health insurance, where we receive emergency care, serious illness care, and preventive care and we only pay a relatively low deductible and relatively low cost-share/copay expenses.

We expect a high level of care. If Grandma gets sick, we expect doctors to pull out all the stops - even if it only adds six months to her lifespan. If little Timmy does something stupid and hurts himself, we expect him to be treated despite his stupidity. If little Sally develops a congenital disease, we expect doctors to provide - and insurers to pay for - all the treatment necessary to give her as close to a normal life as she can have with her condition.

Here are some interesting items that shed a tiny little bit of light on the different healthcare expectations in the U.S. versus the U.K.:

America: Health Insurer to Be Charged With Teen's Murder - ABC News: "The family of a California teenager who died awaiting a liver transplant said they would sue the insurer whom they blame for their daughter's death."

United Kingdom: Treatment for teenager denied liver transplant - Health News, Health & Families - The Independent: "A critically ill teenager who was denied a liver transplant because his condition was drink-related is to be flown to a specialist unit for treatment."

United Kingdom: NHS Blog Doctor: "Poor people get worse medical care than rich people. It's a universal truth throughout the world." The blog is an interesting read, and there are aspects of care that seem exceptional by American standards (housecalls) and aspects where the penny pinching would set Americans marching on Congress demanding that the penny-pinching stop NOW.

No rationing + full care = it doesn't add up

A lot of people get very sick right before they die. It might be terminal illness, acute illness that goes really bad really fast (lethal flu), or a serious accident. They're all costly. Cancer treatment can run a quarter million or more. In Sacramento, a college student recently died from a grisly attack by his roommate; his family received the bill for 5 minutes at the hospital, trying to save the boy's life, and the bill was $29,000. It would have been much higher if the boy had survived - days in ICU, months of rehab, multiple surgeries, pain management, possible infection. Dying is expensive (but it beats the alternative) and cheating or postponing death is expensive.

Wikipedia puts median household income in the U.S. at about $50,000. That's for a household; median annual personal income for all adults is $25k. A person earning $25k pays about $5,000 in social security and federal income tax. Assuming 40 years in the workforce, the median American pays about $200,000 in total federal taxes. That money goes to fund social security, medicare, medicaid, the military, all federal agencies, all federal entitlement programs, etc. In actuality, the federal government only collects $3,600 in income tax per citizen; which works out to $144,000 over 40 working/taxpaying years (a lifetime), but we're going to pay for $30, 60, 90, 500 thousand dollar medical expenses - for a single accident or illness - without rationing?

Right now, American medical spending averages over $7,000 per person. (Washington thinks they're going to cover 40 Million uninsured for $2,500 each.)

5% of Medicare beneficiaries cost an average of $63,000 a year, each. Complications from diabetes can add $47,000 (over a lifetime) in costs for a single patient. ~8% of Americans have diabetes. Lifetime costs for treating diabetes (for a woman) run $233,000 per patient - that's just for the diabetes. Or $423,000 for cardiovascular disease. Remember that these patients can still break bones, fall down wells, catch pneumonia, etc. There is a reason that medical insurance plans often have a lifetime limit of $1 Million per patient - because, sometimes, some people cost more than $1 Million in lifetime healthcare expenses.

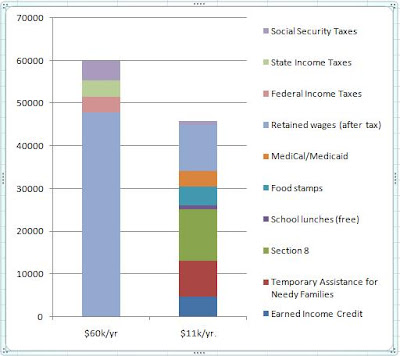

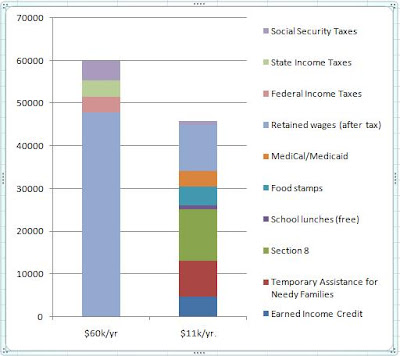

Put another way:

America is different. We all have government health insurance - emergency room care might ruin your credit, but you can use it if you have to. Medicaid (for the poor) helps the very poor - and if someone gets very, very sick, they become poor enough to qualify as soon as they're too disabled to work. Medicare (for the elderly) covers everybody during those critically expensive senior years. Most of us have private health insurance, where we receive emergency care, serious illness care, and preventive care and we only pay a relatively low deductible and relatively low cost-share/copay expenses.

We expect a high level of care. If Grandma gets sick, we expect doctors to pull out all the stops - even if it only adds six months to her lifespan. If little Timmy does something stupid and hurts himself, we expect him to be treated despite his stupidity. If little Sally develops a congenital disease, we expect doctors to provide - and insurers to pay for - all the treatment necessary to give her as close to a normal life as she can have with her condition.

Here are some interesting items that shed a tiny little bit of light on the different healthcare expectations in the U.S. versus the U.K.:

America: Health Insurer to Be Charged With Teen's Murder - ABC News: "The family of a California teenager who died awaiting a liver transplant said they would sue the insurer whom they blame for their daughter's death."

United Kingdom: Treatment for teenager denied liver transplant - Health News, Health & Families - The Independent: "A critically ill teenager who was denied a liver transplant because his condition was drink-related is to be flown to a specialist unit for treatment."

United Kingdom: NHS Blog Doctor: "Poor people get worse medical care than rich people. It's a universal truth throughout the world." The blog is an interesting read, and there are aspects of care that seem exceptional by American standards (housecalls) and aspects where the penny pinching would set Americans marching on Congress demanding that the penny-pinching stop NOW.

No rationing + full care = it doesn't add up

A lot of people get very sick right before they die. It might be terminal illness, acute illness that goes really bad really fast (lethal flu), or a serious accident. They're all costly. Cancer treatment can run a quarter million or more. In Sacramento, a college student recently died from a grisly attack by his roommate; his family received the bill for 5 minutes at the hospital, trying to save the boy's life, and the bill was $29,000. It would have been much higher if the boy had survived - days in ICU, months of rehab, multiple surgeries, pain management, possible infection. Dying is expensive (but it beats the alternative) and cheating or postponing death is expensive.

Wikipedia puts median household income in the U.S. at about $50,000. That's for a household; median annual personal income for all adults is $25k. A person earning $25k pays about $5,000 in social security and federal income tax. Assuming 40 years in the workforce, the median American pays about $200,000 in total federal taxes. That money goes to fund social security, medicare, medicaid, the military, all federal agencies, all federal entitlement programs, etc. In actuality, the federal government only collects $3,600 in income tax per citizen; which works out to $144,000 over 40 working/taxpaying years (a lifetime), but we're going to pay for $30, 60, 90, 500 thousand dollar medical expenses - for a single accident or illness - without rationing?

Right now, American medical spending averages over $7,000 per person. (Washington thinks they're going to cover 40 Million uninsured for $2,500 each.)

5% of Medicare beneficiaries cost an average of $63,000 a year, each. Complications from diabetes can add $47,000 (over a lifetime) in costs for a single patient. ~8% of Americans have diabetes. Lifetime costs for treating diabetes (for a woman) run $233,000 per patient - that's just for the diabetes. Or $423,000 for cardiovascular disease. Remember that these patients can still break bones, fall down wells, catch pneumonia, etc. There is a reason that medical insurance plans often have a lifetime limit of $1 Million per patient - because, sometimes, some people cost more than $1 Million in lifetime healthcare expenses.

Put another way:

- The entire country spends approx. $2.5 Trillion on health care costs.

- For fiscal year 2008, the federal government spent $2.98 Trillion in "cash" expenditures. (Wikipedia)

- For FY2008, the federal government took in $2.52 Trillion in tax income. (Wikipedia) (Roughly equal to our total healthcare spending.)

- We spent almost half a billion dollars more than we took in - in a household, that's called going eyeball-deep into debt. That half a trillion is 16.666 percent of total income. That's like a family earning $50k running up another $8,333 in credit card debt. On top of our existing debt...

- Federal debt is about $12 Trillion right now. Which is 4.8 times as much as we took in this year. That is like a family that earns $50k/year and owns their house outright, having $240,000 in credit card debt to keep up with the Joneses (except the government is keeping up with the Jones' votes by promising them everything under the sun, even though we can't afford it.) Keep in mind - our median family example is not paying that $240k debt down, they're increasing it about $8k every year.

- Anybody who has ever borrowed money knows that you have to pay it back, plus interest. The interest on that debt is food out of our mouths until we pay it off. The U.S. pays almost $400 Billion per year in interest on the national debt. If they were a median family earning $50,000, that family would be paying $8,000 in interest payments - without reducing the debt one dollar.

- We also have a $59 Trillion "unfunded liability." If the government "borrows" money, it's debt. If they sign contracts or pass laws promising to pay money, it is not debt, it is "unfunded liability." To put this in household terms, the $50k/year family has promised all of their 6 kids that mom and dad will put them through Oxford - without scholarships. How does our $50k family plan to pay for $1.18 Million in college costs? If mom and dad spent every penny of their income on college, it would take 24 years to pay off that college "unfunded liability." But they might want to eat. If Mom and Dad devote 50% of their total income to paying for college, it will take them 48 years to pay it off.

- Some moms and dads completely give up on getting out of debt. So when Johnny asks them to put his health insurance on their credit card, they shrug and hand over the card. If you were mom and dad's friend, knowing they have $240,000 in debt, knowing they've signed a million dollar contract with the university, knowing their debt grows $8,000 a year because they are living way too high on the hog for a family earning $50,000, would you advise your friends to pay Johnny's healthcare? Or would you advise them to break the debt addiction?

- Mom and Dad have only one shot at surviving - they have to increase their income. If mom and dad are the IRS and social security, they can increase their income - by raising taxes. A lot.

Sunday, November 08, 2009

How much will the health bill cost you?

The rich, those nameless, faceless, spoiled saints that love to pay for everything, are going to give the rest of us "free" healthcare. Except we know how tricky the rich are - they pass their higher costs on to the rest of us. They fire their nanny, move to a lower tax state, do their shopping in Europe... and then they shift their investments to Luxembourg, cut a couple of jobs at the plant, or raise their prices. So, when you're sitting down to the annual turkey feast saying a prayer of thanks for those nice riches that pay for everything, try not to think about them passing some of the costs to you. Crying at the dinner table is gauche.

So, what if the rich pass the costs on to the rest of us? Well, if Joe Rockefeller raises his widget price 5%, Joe manufacturer has to raise his doodad price a little more than 5% - to cover the financing cost on widgets, plus, he has to make a fair profit on the money he puts at risk in his company. Then Joe Distributor raises his costs high enough to cover the 6% increase in doodad pricing, and Joe Retailer has to raise his prices enough to cover the 7% increase in doodad wholesale costs.

Maybe the rich will just take the extra taxes out of their personal budget. They'll cut back on cocaine and hookers. Weelll, when the rich go and waste their money, it creates jobs and income for others. The rich invest their money in stocks and bonds, and it provides funds for corporations to build new factories, buy new equipment, or meet payroll. Let's hope they don't cut back there! The rich hire servants who rather enjoy having a job (my grandfather sure did), so let's hope they don't fire the nanny. Maybe the rich can cut back on jet trips. Okay, I'll give you that one - but I hate flying, anyway. Oh, wait - if they don't jet off to New York for tea and shopping, New York teahouses and boutiques will have to cut back. See, rich people may waste their money (most don't waste much - that's how they got rich), but what I call "waste," some folks call "income." The French Laundry restaurant provides good jobs for staff; designer boutiques employ a plethora of rude-but-beautiful waifs, even Tiffany keeps customer service reps, designers, craftsmen, accountants, and marketing professionals off the public dole. A direct tax takes money out of your pocket, but an indirect tax can take your name off the staff directory.

So, if the cost of healthcare gets passed on to your family, how much is your share? Well, there are about 100 million taxpayers in America*. The health bill is projected to cost $1 Trillion over 10 years, or about 100 Trillion per year. Divided by 100 million taxpayers/families, that's $1,000 per year. As inflation raises the cost of healthcare, it will raise the cost of the healthcare tax, too. And healthcare inflation seems likely to continue - the bill is not addressing existing cost inefficiencies in health care. In fact, if cost increases strap American families, they may delay preventive care, which would increase the incidence of serious illness and serious complications from illness, adding further upward pressure on health costs.

* I am dividing the cost across taxpayers - instead of all citizens - because not all citizens will bear the cost increases. Children almost never have income, so they almost never bear any costs, so we can exclude the roughly 40 Million Americans who are under age 18. The poor don't pay taxes (they receive earned income credit and welfare) and they don't buy as much stuff as the rest of us, so they will carry very little of the cost load. Welfare recipients will probably receive increased payments if cost inflation rises, which would shift their individual cost-share to the taxpayers who fund welfare programs. For these reasons, I believe that most of the costs will be shifted to people whose income (and spending capacity) qualifies them to pay taxes.

So, what if the rich pass the costs on to the rest of us? Well, if Joe Rockefeller raises his widget price 5%, Joe manufacturer has to raise his doodad price a little more than 5% - to cover the financing cost on widgets, plus, he has to make a fair profit on the money he puts at risk in his company. Then Joe Distributor raises his costs high enough to cover the 6% increase in doodad pricing, and Joe Retailer has to raise his prices enough to cover the 7% increase in doodad wholesale costs.

Maybe the rich will just take the extra taxes out of their personal budget. They'll cut back on cocaine and hookers. Weelll, when the rich go and waste their money, it creates jobs and income for others. The rich invest their money in stocks and bonds, and it provides funds for corporations to build new factories, buy new equipment, or meet payroll. Let's hope they don't cut back there! The rich hire servants who rather enjoy having a job (my grandfather sure did), so let's hope they don't fire the nanny. Maybe the rich can cut back on jet trips. Okay, I'll give you that one - but I hate flying, anyway. Oh, wait - if they don't jet off to New York for tea and shopping, New York teahouses and boutiques will have to cut back. See, rich people may waste their money (most don't waste much - that's how they got rich), but what I call "waste," some folks call "income." The French Laundry restaurant provides good jobs for staff; designer boutiques employ a plethora of rude-but-beautiful waifs, even Tiffany keeps customer service reps, designers, craftsmen, accountants, and marketing professionals off the public dole. A direct tax takes money out of your pocket, but an indirect tax can take your name off the staff directory.

So, if the cost of healthcare gets passed on to your family, how much is your share? Well, there are about 100 million taxpayers in America*. The health bill is projected to cost $1 Trillion over 10 years, or about 100 Trillion per year. Divided by 100 million taxpayers/families, that's $1,000 per year. As inflation raises the cost of healthcare, it will raise the cost of the healthcare tax, too. And healthcare inflation seems likely to continue - the bill is not addressing existing cost inefficiencies in health care. In fact, if cost increases strap American families, they may delay preventive care, which would increase the incidence of serious illness and serious complications from illness, adding further upward pressure on health costs.

* I am dividing the cost across taxpayers - instead of all citizens - because not all citizens will bear the cost increases. Children almost never have income, so they almost never bear any costs, so we can exclude the roughly 40 Million Americans who are under age 18. The poor don't pay taxes (they receive earned income credit and welfare) and they don't buy as much stuff as the rest of us, so they will carry very little of the cost load. Welfare recipients will probably receive increased payments if cost inflation rises, which would shift their individual cost-share to the taxpayers who fund welfare programs. For these reasons, I believe that most of the costs will be shifted to people whose income (and spending capacity) qualifies them to pay taxes.

Thursday, November 05, 2009

Perspective, sometimes

In a lot of ways, we're all just playing cops and robbers, cowboys and, um, noble native Americans. The costumes are more elaborate, the co-conspirators bigger, the Sheriff flabbier, but we're all just bigger, older versions of that little kid who needed comfort and encouragement and inspiration and, sometimes, a monster check under the bed.

Once in a blue moon, I have a moment of perspective. This, I realize, is what I have amounted to. This is that kid's life. Cool. I didn't win the Nobel prize - maybe it's not too late - but I did things I never imagined, did things I did imagine, and I think the little version of me that's been along for the ride is pretty pleased. Not smug, not without regrets, not without scars that have healed and scars that will never heal, but some of the stories would play well on the playground.

I really do have moments when I remember little me - or maybe little me re-emerges and takes the wheel awhile - and think, whoa. Wow.

And tonight I wondered, does President Obama ever think "whoa. I'm president. of the United. Freakin' States."? Did Bush, Reagan, Roosevelt? Forget your politics for a moment - love 'em or hate 'em - wouldn't that be a fun moment? If I were president, I would set aside a moment every day to be proud, awed, and humbled.

Once in a blue moon, I have a moment of perspective. This, I realize, is what I have amounted to. This is that kid's life. Cool. I didn't win the Nobel prize - maybe it's not too late - but I did things I never imagined, did things I did imagine, and I think the little version of me that's been along for the ride is pretty pleased. Not smug, not without regrets, not without scars that have healed and scars that will never heal, but some of the stories would play well on the playground.

I really do have moments when I remember little me - or maybe little me re-emerges and takes the wheel awhile - and think, whoa. Wow.

And tonight I wondered, does President Obama ever think "whoa. I'm president. of the United. Freakin' States."? Did Bush, Reagan, Roosevelt? Forget your politics for a moment - love 'em or hate 'em - wouldn't that be a fun moment? If I were president, I would set aside a moment every day to be proud, awed, and humbled.

Emergency preparedness: Careful how you store your tape

Tape is essential for emergency preparedness. In a hurricane zone, applying a big "x" of tape to exterior windows can reduce flying glass. It can be used to label things, close things, hold things open, hold things closed, you can tape plastic over a window to improve insulation, you can wrap metal tools to simulate an insulated/padded handle - duct tape is essential. Most men believe that anything you can't fix with duct tape, doesn't really need fixing.

But, you have to store it right. The garage seems like a natural place to keep duct tape, but it's one of the worst places to store it. My garage ranges from baking in the summer to freezing in the winter - all that temperature change made the glue on the duct tape glue the roll into a solid block. It's useless now.

More Tape Tips page 3: "If you need to store tape for a long time, keep it in a cool, dry place and turn it over from time to time so that the adhesive doesn’t migrate to one side of the roll."

Put waxed paper between rolls of tape to keep them from sticking together when stacked.

But, you have to store it right. The garage seems like a natural place to keep duct tape, but it's one of the worst places to store it. My garage ranges from baking in the summer to freezing in the winter - all that temperature change made the glue on the duct tape glue the roll into a solid block. It's useless now.

More Tape Tips page 3: "If you need to store tape for a long time, keep it in a cool, dry place and turn it over from time to time so that the adhesive doesn’t migrate to one side of the roll."

Put waxed paper between rolls of tape to keep them from sticking together when stacked.

Monday, November 02, 2009

Emergency preparedness is sooo 1950's

I didn't grow up with a family bomb-shelter or nuke drills at school. I am from the neglected generation, too early for school shooter lockdown drills and too late for the Red Scare. We beat the Russkies before I finished high school, and it was already evident that they were dying an economic death before that. Our parents were more likely to have grown up in bell-bottoms than poodle skirts. Rugged self-reliance was a sure sign of a Vietnam vet who hadn't come down from the panic yet.

No matter. The risks are different today, anyway. Our population is huge. Most of us live within 30 miles of a hospital and within 100 miles of a potential riot threat. How many times has Los Angeles burned? I remember the occasional childhood news report about grocery stores with ransacked shelves - usually during heavy rains. Now, grocers use just-in-time distribution to minimize shelf-spoilage and store rents, but that also means stores don't have much supply for panicked consumers. Forget the Russians, we're more worried about the Mexicans, the terrorists, the inner-city punks. We've gone almost native on natural disaster threats. I don't see many storm shelters, but I have heard people say "if I die in an Earthquake, it's God's will." After the earthquake, I'm sure the tune will change. I saw news interviews with people after one of Southern California's severe earthquakes - people were angry with grocery stores for running out of supplies, explaining that, since they don't cook, they don't keep food in the house.

Most of us have some food in the house. Most of us could survive a few miserable days eating plain canned beans in a disaster, even without a plan. Most of us don't, however, have a week's worth of water. We don't even know how much water we would need. We haven't stockpiled toilet paper or tylenol. We wouldn't need food, anyway - if the TV went out for more than 12 hours, there would be a line to jump off the nearest bridge. Lose the internet, and people will be calling the cops out and meeting them at the door with soap carved into a shiv yelling "just shoot me, please, put me out of my misery!" And who could blame them - have you ever tried having a conversation with your family? (j/k)

Now we face multiple possible pandemics, with one (swine flu) actually labeled a pandemic but, at this time, it is a fairly mild illness. The fear, however, is that swine flu will behave like the 1918 pandemic, which started with a mild flu in the spring and returned as a virulent soldier killer in the fall. Don't we have enough to worry about already, with terrorists and the economy and razor blades in Halloween candy? Anybody with a lick of sense has tuned out, bought a wii, and turned on, right? Besides, Swine flu is milder than regular flu. Except when it isn't.

Is your family prepared to spend a week too sick to shop or cook? Can you handle having mom or dad in the ICU for 3 months? Who will watch the kids if mom or dad spends a day or two in the hospital (many hospitals have banned young children from visiting hospital patients due to the flu). If the flu stays mild, you're unlikely to be hospitalized. But there are still stray bullets, reckless drivers, unknown food or bee allergies, etc.

If the flu does get bad, you and yours might stay healthy. You still might be impacted by absenteeism at work. Your electric company might not have enough workers to restore power quickly after the next storm. What if a natural disaster hit in the midst of a nasty flu season? Government aid isn't guaranteed in the first place - we're advised to have a 3-day supply of food and water and several weeks' supplies in case we have to shelter in place - but it could be delayed further by a nasty flu season, even without a pandemic or particularly deadly flu.

If you have an emergency preparedness plan, have you considered the possibility of being sick during a crisis? Have you considered the possibility of quarantine? In my area, there aren't too many natural disasters - floods are localized, we don't have an earthquake fault, we don't get hurricanes, and tornadoes are incredibly rare. But I hadn't really thought about being quarantined, and many of my emergency food stocks take more effort than a sick family would want to expend. I am adding a supply of ready-to-eat soups now. If the flu threat worsens, will communities open emergency shelters in a natural disaster?

If you haven't started preparing for an emergency, please start. Here's a very simple, basic plan: 2 gallons of water per person (or more if you can), 6 cans of Chunky soup or beefaroni per person (with pull-tab tops), a bottle of tylenol or ibuprofen, a large bottle of hand sanitizer, a deck of cards, and a box of breakfast bars or granola bars. It isn't much, but it can keep you alive for 3 days, you can throw it in a backpack for an evacuation, and it doesn't cost a whole heck of a lot. I would also add a battery powered radio, a flashlight or lantern, and batteries for both, along with plastic forks/spoons, a can opener, matches, candles, a couple of clean 5-gallon buckets (you can buy them at Home Depot) and a box of trash bags.

Keep everything together in case you need to evacuate (if you store empty suitcases, you can put your emergency supplies in a suitcase, just be sure to store it in the house or basement where temperatures won't exceed 72 degrees often). If you have pets, add a small bag of animal food and more water. You can just buy several gallon or 2 1/2 gallon bottles at the grocery store. If that seems too expensive, then wash out your empty 2 liter soda bottles, disinfect with a splash of bleach in water, rinse thoroughly, and fill with tap water. If your freezer has room, stuff some 3/4 full botles of water in the freezer and they can double as ice packs for your cooler if the refrigerator dies or the power goes out.

Don't use milk jugs to store drinking water - they're fine for toilet-flushing water, but FEMA says it isn't feasible to truly disinfect milk bottles, so you could have nasty germs growing in your survival water. Yuck.

No matter. The risks are different today, anyway. Our population is huge. Most of us live within 30 miles of a hospital and within 100 miles of a potential riot threat. How many times has Los Angeles burned? I remember the occasional childhood news report about grocery stores with ransacked shelves - usually during heavy rains. Now, grocers use just-in-time distribution to minimize shelf-spoilage and store rents, but that also means stores don't have much supply for panicked consumers. Forget the Russians, we're more worried about the Mexicans, the terrorists, the inner-city punks. We've gone almost native on natural disaster threats. I don't see many storm shelters, but I have heard people say "if I die in an Earthquake, it's God's will." After the earthquake, I'm sure the tune will change. I saw news interviews with people after one of Southern California's severe earthquakes - people were angry with grocery stores for running out of supplies, explaining that, since they don't cook, they don't keep food in the house.

Most of us have some food in the house. Most of us could survive a few miserable days eating plain canned beans in a disaster, even without a plan. Most of us don't, however, have a week's worth of water. We don't even know how much water we would need. We haven't stockpiled toilet paper or tylenol. We wouldn't need food, anyway - if the TV went out for more than 12 hours, there would be a line to jump off the nearest bridge. Lose the internet, and people will be calling the cops out and meeting them at the door with soap carved into a shiv yelling "just shoot me, please, put me out of my misery!" And who could blame them - have you ever tried having a conversation with your family? (j/k)

Now we face multiple possible pandemics, with one (swine flu) actually labeled a pandemic but, at this time, it is a fairly mild illness. The fear, however, is that swine flu will behave like the 1918 pandemic, which started with a mild flu in the spring and returned as a virulent soldier killer in the fall. Don't we have enough to worry about already, with terrorists and the economy and razor blades in Halloween candy? Anybody with a lick of sense has tuned out, bought a wii, and turned on, right? Besides, Swine flu is milder than regular flu. Except when it isn't.

Is your family prepared to spend a week too sick to shop or cook? Can you handle having mom or dad in the ICU for 3 months? Who will watch the kids if mom or dad spends a day or two in the hospital (many hospitals have banned young children from visiting hospital patients due to the flu). If the flu stays mild, you're unlikely to be hospitalized. But there are still stray bullets, reckless drivers, unknown food or bee allergies, etc.

If the flu does get bad, you and yours might stay healthy. You still might be impacted by absenteeism at work. Your electric company might not have enough workers to restore power quickly after the next storm. What if a natural disaster hit in the midst of a nasty flu season? Government aid isn't guaranteed in the first place - we're advised to have a 3-day supply of food and water and several weeks' supplies in case we have to shelter in place - but it could be delayed further by a nasty flu season, even without a pandemic or particularly deadly flu.

If you have an emergency preparedness plan, have you considered the possibility of being sick during a crisis? Have you considered the possibility of quarantine? In my area, there aren't too many natural disasters - floods are localized, we don't have an earthquake fault, we don't get hurricanes, and tornadoes are incredibly rare. But I hadn't really thought about being quarantined, and many of my emergency food stocks take more effort than a sick family would want to expend. I am adding a supply of ready-to-eat soups now. If the flu threat worsens, will communities open emergency shelters in a natural disaster?

If you haven't started preparing for an emergency, please start. Here's a very simple, basic plan: 2 gallons of water per person (or more if you can), 6 cans of Chunky soup or beefaroni per person (with pull-tab tops), a bottle of tylenol or ibuprofen, a large bottle of hand sanitizer, a deck of cards, and a box of breakfast bars or granola bars. It isn't much, but it can keep you alive for 3 days, you can throw it in a backpack for an evacuation, and it doesn't cost a whole heck of a lot. I would also add a battery powered radio, a flashlight or lantern, and batteries for both, along with plastic forks/spoons, a can opener, matches, candles, a couple of clean 5-gallon buckets (you can buy them at Home Depot) and a box of trash bags.

Keep everything together in case you need to evacuate (if you store empty suitcases, you can put your emergency supplies in a suitcase, just be sure to store it in the house or basement where temperatures won't exceed 72 degrees often). If you have pets, add a small bag of animal food and more water. You can just buy several gallon or 2 1/2 gallon bottles at the grocery store. If that seems too expensive, then wash out your empty 2 liter soda bottles, disinfect with a splash of bleach in water, rinse thoroughly, and fill with tap water. If your freezer has room, stuff some 3/4 full botles of water in the freezer and they can double as ice packs for your cooler if the refrigerator dies or the power goes out.

Don't use milk jugs to store drinking water - they're fine for toilet-flushing water, but FEMA says it isn't feasible to truly disinfect milk bottles, so you could have nasty germs growing in your survival water. Yuck.

Saturday, October 31, 2009

Morning Drivetime DUI: How many drinks can you sleep off in 8 hours?

Chronic DUI driver gets two years in prison: "A breath test an hour later showed that his blood-alcohol level was .22 percent, nearly three times the .08 percent level that constitutes drunken driving, authorities said." This was at 8 am.

When I took my first driving test, the only questions I missed were the DUI questions. It wasn't going to affect me, so I didn't pay much attention. That has remained true throughout my life - I avoid driving after drinking and I wait two hours per drink before driving if I absolutely HAVE to drive. So BAC hasn't been on my radar.

But this article piqued my interest and I looked up BAC. I was a bit surprised. By one source, it takes 45 minutes to lower BAC by .01, so the driver in this article would take over 16 hours to completely sober up. Granted, getting drunk to the .22 BAC level is a lot of hard work (depending on the guy's weight, it would take him 6 to 15 drinks in an hour, or 6 to 15 drinks more than his body broke down over the time he was drinking, to reach .22), so you could be talking a full 24 hour cycle, 8 hours of drinking to get that drunk, 16 hours to sober up. It would take him 11 1/4 hours to drop from a .22 BAC to the .07 BAC level that would make it legal to drive again, over 16 hours to totally sober up.

Women have it tougher, unless they bulk up. A little 120 lb. woman would reach a BAC of .22 with just 6 drinks. According to drinkinganddriving.org, an average person takes 45 minutes to lower their BAC by .01, so the woman would still need 11 1/4 hours to get down to the legal limit - although drivers are still impaired at .07, and can still be prosecuted for driving under the influence if they get into an incident behind the wheel - so the goal is to metabolize the alcohol down to a BAC of 0. From a BAC of .22, it takes 16 1/2 hours to drop to 0. Yikes. It's likely we've got a lot of drunk drivers in the morning commute.

Even the responsible drinker who walks to the bar or has a designated driver needs to count drinks if they're planning to drive in the morning. Put another way, if someone wants to wake up sober in 8 hours, the maximum BAC that can be metabolized over 8 hours of sleeping is about 10.66, 3 drinks for a little guy, 7 drinks for a 240 pound fellow, 2 1/2 drinks for a 100 lb. woman, 6 drinks for a 240 pound woman. So, for fun, I put together this handy little chart.

When I took my first driving test, the only questions I missed were the DUI questions. It wasn't going to affect me, so I didn't pay much attention. That has remained true throughout my life - I avoid driving after drinking and I wait two hours per drink before driving if I absolutely HAVE to drive. So BAC hasn't been on my radar.

But this article piqued my interest and I looked up BAC. I was a bit surprised. By one source, it takes 45 minutes to lower BAC by .01, so the driver in this article would take over 16 hours to completely sober up. Granted, getting drunk to the .22 BAC level is a lot of hard work (depending on the guy's weight, it would take him 6 to 15 drinks in an hour, or 6 to 15 drinks more than his body broke down over the time he was drinking, to reach .22), so you could be talking a full 24 hour cycle, 8 hours of drinking to get that drunk, 16 hours to sober up. It would take him 11 1/4 hours to drop from a .22 BAC to the .07 BAC level that would make it legal to drive again, over 16 hours to totally sober up.

Women have it tougher, unless they bulk up. A little 120 lb. woman would reach a BAC of .22 with just 6 drinks. According to drinkinganddriving.org, an average person takes 45 minutes to lower their BAC by .01, so the woman would still need 11 1/4 hours to get down to the legal limit - although drivers are still impaired at .07, and can still be prosecuted for driving under the influence if they get into an incident behind the wheel - so the goal is to metabolize the alcohol down to a BAC of 0. From a BAC of .22, it takes 16 1/2 hours to drop to 0. Yikes. It's likely we've got a lot of drunk drivers in the morning commute.

Even the responsible drinker who walks to the bar or has a designated driver needs to count drinks if they're planning to drive in the morning. Put another way, if someone wants to wake up sober in 8 hours, the maximum BAC that can be metabolized over 8 hours of sleeping is about 10.66, 3 drinks for a little guy, 7 drinks for a 240 pound fellow, 2 1/2 drinks for a 100 lb. woman, 6 drinks for a 240 pound woman. So, for fun, I put together this handy little chart.

How many drinks can an average person sleep off in 8 hours?

Caveats:

Alcohol metabolism varies from person to person. Dehydration, overall health, presence of other drugs in the bloodstream, including prescription and over-the-counter medications, etc., can impact blood alcohol absorption and metabolism. This chart is not advice for a specific person but merely a representation of assumptions about an "average" person.

Methodology:

Blood alcohol level continues rising after the last drink is ingested, so I assumed 7 hours to metabolize the drinks consumed. In 7 hours, at a rate of .01 BAC per hour, an average person can drop from a BAC of .093 to .00. Using the charts from drinkinganddriving.org, I divided the BAC per drink by weight into the .093 BAC that can be metabolized in 7 hours, arriving at the number of drinks metabolized in 7 hours.

Blood alcohol level continues rising after the last drink is ingested, so I assumed 7 hours to metabolize the drinks consumed. In 7 hours, at a rate of .01 BAC per hour, an average person can drop from a BAC of .093 to .00. Using the charts from drinkinganddriving.org, I divided the BAC per drink by weight into the .093 BAC that can be metabolized in 7 hours, arriving at the number of drinks metabolized in 7 hours.

Most people do not slam 2 to 5 drinks, one right after another, and go to bed. But if you go to bed at 10 pm and drive to work at 6 am, an average man can only sleep off 3 or 4 drinks. Figure you get off work, go to dinner, stop at the bar at 8 and leave at 10... I never realized how few drinks an average man can sleep off between 10 pm and the 6 am commute. If you're talking about the partying youngsters staying 'til closing time at 2 am, even a big guy can only sleep off 2 drinks before morning commute, and most folks don't stay at a bar 'til 2 am for just 2 drinks. Add in the variability of individual alcohol metabolism and the fact that a patron doesn't usually know if a mixed drink contains exactly 1 oz of liquor or if a glass of wine is exactly 5 ounces, and it's tough for a person to know their exact BAC when they leave a bar or party, let alone 8 hours later when leaving for work.

Maybe you'd find these charts more realistic:

Friday, October 30, 2009

Legislating to the Lowest Common Denominator (pardon my language)

Today I had to send a copy of my driver's license to buy psuedoephedrine allergy medicine by mail order. How about you create a list of people who actually committed drug crimes, and make them jump through hoops to buy pseudoephedrine. Stop hassling honest, responsible, law-abiding citizens. Stop legislating to the lowest common denominator. Put the burden of stupidity on the stupid and leave the rest of us the hell out of it.

If existing laws don't encourage law-abiding behavior, it's because you aren't enforcing them or the penalty isn't severe enough or the law doesn't belong on the books. Forcing honest people to jump through hoops in a futile attempt to force dishonest people to be honest - it isn't working, it's a flawed idea, and I'm tired of being bullied because lawmakers don't understand that the criminals don't CARE what the law is. That's why they're criminals. Do you really think that meth heads won't break into pharmacies if you cut off their supply? Has this law solved the meth problem? Then why do I have to jump through hoops to get freakin' cold medicine?

People convicted of a DUI don't have to register their purchases on a Federal database to buy alcohol. Hell, when federal drug databases DO catch abuse, nothing happens. When we get an explosion of laws and regulations, authorities can't enforce them all, and it's only honest people who suffer - honest people waste time and effort and money trying to understand and comply with all the regulations dumped on them, while the crooks continue to rob, lie, cheat, and steal.

I would like to see a constitutional amendment that specifies that every proposed law or rule MUST include specific plans for funding AND enforcement for at least 10 years, with a requirement that all laws are evaluated for possible unintended consequences over a 10-year period, AND all laws not directly impacting the safety of citizens expire after 10 years unless it is renewed by lawmakers, and, lastly, only emergency legislation can come up for a vote before voters have had 60 days to evaluate proposed legislation and contact their legislators with input.

Why shouldn't we hold lawmakers to a high standard of legislative quality? Why shouldn't they jump through some hoops before they force us to jump through hoops?

If existing laws don't encourage law-abiding behavior, it's because you aren't enforcing them or the penalty isn't severe enough or the law doesn't belong on the books. Forcing honest people to jump through hoops in a futile attempt to force dishonest people to be honest - it isn't working, it's a flawed idea, and I'm tired of being bullied because lawmakers don't understand that the criminals don't CARE what the law is. That's why they're criminals. Do you really think that meth heads won't break into pharmacies if you cut off their supply? Has this law solved the meth problem? Then why do I have to jump through hoops to get freakin' cold medicine?

People convicted of a DUI don't have to register their purchases on a Federal database to buy alcohol. Hell, when federal drug databases DO catch abuse, nothing happens. When we get an explosion of laws and regulations, authorities can't enforce them all, and it's only honest people who suffer - honest people waste time and effort and money trying to understand and comply with all the regulations dumped on them, while the crooks continue to rob, lie, cheat, and steal.

I would like to see a constitutional amendment that specifies that every proposed law or rule MUST include specific plans for funding AND enforcement for at least 10 years, with a requirement that all laws are evaluated for possible unintended consequences over a 10-year period, AND all laws not directly impacting the safety of citizens expire after 10 years unless it is renewed by lawmakers, and, lastly, only emergency legislation can come up for a vote before voters have had 60 days to evaluate proposed legislation and contact their legislators with input.

Why shouldn't we hold lawmakers to a high standard of legislative quality? Why shouldn't they jump through some hoops before they force us to jump through hoops?

Tuesday, October 06, 2009

we wil inhairet ur wurld wether u lik it or not (don't worry - the actual post is in real English)

Do you ever think about the fact that these txt'ng young people will be the ones running your senior centers, funding your Social Security, and controlling the media in your old age? How does that make you feel?

Do you think names will be spelled fu-net-ickly on pension checks? Breakups, firings, layoffs, death notices, and denial of benefits will be notified via text message. Suspenders will come back in style as today's youth refuse to pull their pants up but discover the hazards of trying to actually accomplish something with baggy pants halfway down their thighs. Roadway lanes will officially be recognized as mere "suggestions" and showing up to work on a "schedule" will be voluntary - even for judges, police officers, ER docs, etc. Oh, yeah - there won't be any primary care docs. The existing med school system won't let go of the brutal academic and residency requirements, so only materialistic young folk will suffer through it - and they ain't doing it for a piddling quarter mil a year.

The Star Spangled Banner will be re-recorded as a rap song, and our grandchildren's generation will rebel against their parents boring rap music - by embracing country music. Teenaged rebellion will end, because teens simply cannot shock their parents anymore with anything short of 1) fiscally and socially responsible behavior and/or 2) killing things. Google's face-recognition technology will be perfected, and Google will make a trillion bucks by searching out your doppelganger and hiring him/her to go out and make friends for you, without you having to suffer the inconvenience of pretending to care about "friends'" stupid lives and boring interests.

Americans will stage a bloodless coup in the entertainment industry, wresting control back from the Canadians. We will discover that 47% of illegal "Mexican" immigrants are actually illegal Canadian immigrants with their first-ever tan.

Naw. I think that the primacy of connection will fade and today's youth will discover the joy of workaholism to avoid dealing with non-work life. But I do think their kids will struggle to rebel musically, and I fear that they will decide to rebel by playing Country and Western music at a polite volume, wearing belts that hold their pants at their waist, and either taking piercing to the next level (pierced ribs, perhaps?) or eschewing piercing altogether. And all of today's citizens complaining about illegals taking American jobs, will find themselves complaining that they can't find home healthcare aids to change their Depends. Yes folks, even today's troubled youth can grow into tomorrow's entitled retirement class, but, first, they've got to kill us off to collect their inheritances. Nighty-night, sleep tight.

Do you think names will be spelled fu-net-ickly on pension checks? Breakups, firings, layoffs, death notices, and denial of benefits will be notified via text message. Suspenders will come back in style as today's youth refuse to pull their pants up but discover the hazards of trying to actually accomplish something with baggy pants halfway down their thighs. Roadway lanes will officially be recognized as mere "suggestions" and showing up to work on a "schedule" will be voluntary - even for judges, police officers, ER docs, etc. Oh, yeah - there won't be any primary care docs. The existing med school system won't let go of the brutal academic and residency requirements, so only materialistic young folk will suffer through it - and they ain't doing it for a piddling quarter mil a year.

The Star Spangled Banner will be re-recorded as a rap song, and our grandchildren's generation will rebel against their parents boring rap music - by embracing country music. Teenaged rebellion will end, because teens simply cannot shock their parents anymore with anything short of 1) fiscally and socially responsible behavior and/or 2) killing things. Google's face-recognition technology will be perfected, and Google will make a trillion bucks by searching out your doppelganger and hiring him/her to go out and make friends for you, without you having to suffer the inconvenience of pretending to care about "friends'" stupid lives and boring interests.

Americans will stage a bloodless coup in the entertainment industry, wresting control back from the Canadians. We will discover that 47% of illegal "Mexican" immigrants are actually illegal Canadian immigrants with their first-ever tan.

Naw. I think that the primacy of connection will fade and today's youth will discover the joy of workaholism to avoid dealing with non-work life. But I do think their kids will struggle to rebel musically, and I fear that they will decide to rebel by playing Country and Western music at a polite volume, wearing belts that hold their pants at their waist, and either taking piercing to the next level (pierced ribs, perhaps?) or eschewing piercing altogether. And all of today's citizens complaining about illegals taking American jobs, will find themselves complaining that they can't find home healthcare aids to change their Depends. Yes folks, even today's troubled youth can grow into tomorrow's entitled retirement class, but, first, they've got to kill us off to collect their inheritances. Nighty-night, sleep tight.

Labels:

Canada,

Country music,

jailin',

piercing,

rap isn't music,

rap music,

retirement planning,

sillyness,

texting,

Youth

Tuesday, September 29, 2009

What is the purpose of government?

Imagine a world without governments. Think back hundreds and thousands of years, early humans, sparse populations, no mail or even currencies, just people, living their lives and trying to get by. Somebody says to these non-citizens, "Hey, I've got a great idea. Let's form a government!" What justification would be offered to entice people into becoming citizens, giving a portion of their crops to a tax collector, limiting their freedoms, bowing to the will of a monarch or a their fellow citizens? Pretend for a moment that the citizens aren't conquered or forced into citizenship; they are voluntarily subjecting themselves to government. Why? Really think about this for a minute.

Your answer forms the essence of your underlying beliefs about the purpose of government. The reasons I come up with are, first and foremost, protection from harm, senseless violence, theft, and murder. Establishment of reasonable laws that allow the most people to enjoy continued life and freedom from harm so they can continue to produce, to be family members and community members, without fear of having all that they have earned and produced taken from them unjustly. Establishing and training an army to defend against invasion would also fall under protection from harm.

The second reason I imagine is enforcement of contracts, establishment of currency, and similar rules that allow people to trade safely and fairly. I call this facilitation of commerce. If I promise to give you seeds now in exchange for food later, and you don't provide them, I may never trade seeds again. Then the only people who can farm are the ones who have something to trade in hand, right now.

I don't think people formed governments to provide sustenance to their neediest neighbors - they can do that without government. Even if they don't want to find the needy neighbor themselves, churches and other charities handle gifts of kindness quite well. I imagine a group of villagers discussing government and, if the topic of welfare came up, I imagine five of them saying "hey, Joe only needs welfare because he's lazy. If he wants food, send him over and I'll put him to work, and Jimmie - poor, old childless widower Jimmie - he should of put somethin' back when he was younger, but what's done is done. We all take turns over there, bringing him food and slopping his hogs. We don't need no government to do that!" (I don't think governments formed to provide mail services, since such a thing was barely contemplated and only affordable to the very wealthy, not that I object to the postal service - by providing a consistent means of giving legal notice, it facilitates commerce. There are plenty of new government roles that fall under the facilitating commerce and protecting from harm.)

So given my belief that the number one most important function of the government is protecting us from harm, I am disgusted and outraged at the laxity of law enforcement, the non-punitive nature of prison, and the failure to prosecute or even investigate so many crimes. Similarly, I think that military aggression is a breach of governmental purpose, since it unnecessarily puts citizen soldiers in harms way (and I say this in global terms, without any particular meaning about any current military action by any nation). Citizens have every right to ask whether a military action, over an event that does not put citizens in direct risk of harm right now, is a defensive or offensive move.

Your answer forms the essence of your underlying beliefs about the purpose of government. The reasons I come up with are, first and foremost, protection from harm, senseless violence, theft, and murder. Establishment of reasonable laws that allow the most people to enjoy continued life and freedom from harm so they can continue to produce, to be family members and community members, without fear of having all that they have earned and produced taken from them unjustly. Establishing and training an army to defend against invasion would also fall under protection from harm.

The second reason I imagine is enforcement of contracts, establishment of currency, and similar rules that allow people to trade safely and fairly. I call this facilitation of commerce. If I promise to give you seeds now in exchange for food later, and you don't provide them, I may never trade seeds again. Then the only people who can farm are the ones who have something to trade in hand, right now.

I don't think people formed governments to provide sustenance to their neediest neighbors - they can do that without government. Even if they don't want to find the needy neighbor themselves, churches and other charities handle gifts of kindness quite well. I imagine a group of villagers discussing government and, if the topic of welfare came up, I imagine five of them saying "hey, Joe only needs welfare because he's lazy. If he wants food, send him over and I'll put him to work, and Jimmie - poor, old childless widower Jimmie - he should of put somethin' back when he was younger, but what's done is done. We all take turns over there, bringing him food and slopping his hogs. We don't need no government to do that!" (I don't think governments formed to provide mail services, since such a thing was barely contemplated and only affordable to the very wealthy, not that I object to the postal service - by providing a consistent means of giving legal notice, it facilitates commerce. There are plenty of new government roles that fall under the facilitating commerce and protecting from harm.)

So given my belief that the number one most important function of the government is protecting us from harm, I am disgusted and outraged at the laxity of law enforcement, the non-punitive nature of prison, and the failure to prosecute or even investigate so many crimes. Similarly, I think that military aggression is a breach of governmental purpose, since it unnecessarily puts citizen soldiers in harms way (and I say this in global terms, without any particular meaning about any current military action by any nation). Citizens have every right to ask whether a military action, over an event that does not put citizens in direct risk of harm right now, is a defensive or offensive move.

Thursday, September 24, 2009

Drowning in fine print

Contracts are everywhere. I am averaging multiple contracts per day. Is it realistic to expect consumers to read and understand so many contracts when the average person doesn't even read one book a year?

I just tried to purchase an item on Etsy (the artist/crafters-direct sales site). At checkout, I had to create an account and check a box saying that I agree with Etsy's terms and conditions. So I opened the terms and conditions. The main body is 26 sections 12 pages and over 4,000 words, with another 4 documents incorporated by reference, two of which were about as long as (or longer than) the actual terms and conditions.

I can't make the purchase without agreeing to the contract. I am not going to agree to a contract without reading it. I don't have time to read a 20+ page document to make a simple purchase. So no sale. I bet the seller would have preferred to have a sale.

The average adult supposedly reads 250-300 words per minute. The Etsy terms and conditions alone would take about 14 minutes. The T&C plus the other documents incorporated by reference total a staggering 12,422 words. At 300 words per minute, that is more than 40 minutes of reading, to buy a $15 tchotchke. I wish I were kidding. I wish this was rare. Nope. Ain't rare. Ain't reasonable, either. You can't even watch Better Off Ted without signing a contract. Come on. Doesn't the law already cover most of this stuff?

Instead of a traditional tv/cable box/vcr entertainment center, I have an entertainment computer. It can play regular and blu-ray DVDs, tune in television stations, and play web-based entertainment, including Hulu, Netflix, and YouTube. There is a small problem, though. Because the system is across the room (though on a large screen TV), we have our browser set to display text in "very large." Most TV websites are configured to use the exact font style and size that the designer specifies, without scaling. When we try to watch a show - say, on ABC.com (the absolute worst offender) - we have to agree to the terms and conditions. Except they're not legible from across the room when the web designer doesn't allow the text to scale to the browser settings. So we're supposed to agree to a binding contract that we cannot read. It is the equivalent of a 4-6 point font. If you printed a written contract that small, it would not be enforceable. Yet companies think that their web contracts will be enforceable because they look right on the designer's monitor!

When I take my car in for service, signing the front of the service contract means I agree to everything on the back of the contract. When I go to the doctor's office, same thing - I have to certify that I agree with their privacy policy, that I agree to assign insurance benefits to them, and a couple other contracts that they make me sign on a regular basis. They get pissy about "holding up the line" if I actually read the contracts before signing them, and they're shocked that I ask for a copy (I don't sign anything that I don't get a copy of). And then there's always some clause about my having received some notice, which I haven't received, and it's a problem to track down a copy for me. Oh, yes, the reaction I get when I insist on reading a contract before signing it, having a copy, asking questions - it is clear that 1) most people don't read the contract(s) and 2) most companies count on people not reading the contracts.

It is an insidious loop. Consumers don't read the contract, so companies develop their procedures around that - like presenting a contract to the consumer and allowing 5 seconds for the consumer to sign, any longer holds up the line or keeps an employee from returning to their important work (because dealing with a customer who is signing a contract isn't important) and then an average consumer tries to read the contract and gets socially slapped down for it, so he or she doesn't try to read contracts anymore.

Not me. I'm antisocial. If I sign a contract, I'm going to read it, and if that inconveniences the party requesting the contract - they should have considered the possibility that some people want to know what rights they're signing away. When I bought my first house with my first spouse, we sat down at closing and I read the mortgage contract. I read the purchase contract to make sure it was recorded correctly. I read every single thing I signed, and I reviewed the list of 360 payment amounts to make sure it gibed with what I THOUGHT I was signing. And every single person at the closing table made pointed jokes, then tapped their fingers, then told me I didn't need to read the contracts, then sighed deeply, then told me that NO ONE reads the contracts. Halfway through, my spouse picked up on the social cues for me to stop reading, and parroted the "I'm sure it's all correct, nobody reads it, just sign and move on" messages from the "professionals." (That's a big part of why I'm on my second spouse. I am more concerned with signing an accurate contract than with impressing the salespeople that I am "easy to get along with" when that means potentially signing away major rights, privileges, or dollars. That, and the fact that I'm a jackass who makes everybody uncomfortable by reading contracts and such.)

That's right, people who sign contracts without reading are not just taking huge risks, they are harming people who DO read contracts. Company lawyers get emboldened by the knowledge that consumers don't read the contract. So they put things into the contract that most consumers would not willingly agree to (like eBay's infamous "we are just a venue, if you get ripped of, tough tooties") and then they write 20-40 page contracts because, hey, nobody reads them anyway, so it isn't an inconvenience to the customer to deal with ENORMOUS long contracts.

So, no matter how responsible or persnickety (or whatever adjective YOU choose) you are about reading contracts, you have to share a world with the illiterates of the world (people who can read but don't read even when it's really important, may as well be illiterate so I'm lumping them in with people who actually can't read). How long would a company stay in business if they forced customers to sign a 20 page document before letting them buy something, if most customers actually read the contract? Stores would only be open on Sundays, because that would be the only day people had enough time to shop! Consumerism would die on the vine.

Now, the mortgage crisis has shown that a lot of people were swimming naked, contract-wise. I wonder if people are going to start paying more attention to what they're signing? If so, will they object to spending 40 minutes reading a contract for the privilege of buying something for less than $20? Will people hire lawyers to translate the terms and conditions on Twitter, or will they just say no? Maybe consumer contracts will go back to being sane, rational two-paragraph statements. Ah, I can dream.

I just tried to purchase an item on Etsy (the artist/crafters-direct sales site). At checkout, I had to create an account and check a box saying that I agree with Etsy's terms and conditions. So I opened the terms and conditions. The main body is 26 sections 12 pages and over 4,000 words, with another 4 documents incorporated by reference, two of which were about as long as (or longer than) the actual terms and conditions.

I can't make the purchase without agreeing to the contract. I am not going to agree to a contract without reading it. I don't have time to read a 20+ page document to make a simple purchase. So no sale. I bet the seller would have preferred to have a sale.

The average adult supposedly reads 250-300 words per minute. The Etsy terms and conditions alone would take about 14 minutes. The T&C plus the other documents incorporated by reference total a staggering 12,422 words. At 300 words per minute, that is more than 40 minutes of reading, to buy a $15 tchotchke. I wish I were kidding. I wish this was rare. Nope. Ain't rare. Ain't reasonable, either. You can't even watch Better Off Ted without signing a contract. Come on. Doesn't the law already cover most of this stuff?

Instead of a traditional tv/cable box/vcr entertainment center, I have an entertainment computer. It can play regular and blu-ray DVDs, tune in television stations, and play web-based entertainment, including Hulu, Netflix, and YouTube. There is a small problem, though. Because the system is across the room (though on a large screen TV), we have our browser set to display text in "very large." Most TV websites are configured to use the exact font style and size that the designer specifies, without scaling. When we try to watch a show - say, on ABC.com (the absolute worst offender) - we have to agree to the terms and conditions. Except they're not legible from across the room when the web designer doesn't allow the text to scale to the browser settings. So we're supposed to agree to a binding contract that we cannot read. It is the equivalent of a 4-6 point font. If you printed a written contract that small, it would not be enforceable. Yet companies think that their web contracts will be enforceable because they look right on the designer's monitor!

When I take my car in for service, signing the front of the service contract means I agree to everything on the back of the contract. When I go to the doctor's office, same thing - I have to certify that I agree with their privacy policy, that I agree to assign insurance benefits to them, and a couple other contracts that they make me sign on a regular basis. They get pissy about "holding up the line" if I actually read the contracts before signing them, and they're shocked that I ask for a copy (I don't sign anything that I don't get a copy of). And then there's always some clause about my having received some notice, which I haven't received, and it's a problem to track down a copy for me. Oh, yes, the reaction I get when I insist on reading a contract before signing it, having a copy, asking questions - it is clear that 1) most people don't read the contract(s) and 2) most companies count on people not reading the contracts.

It is an insidious loop. Consumers don't read the contract, so companies develop their procedures around that - like presenting a contract to the consumer and allowing 5 seconds for the consumer to sign, any longer holds up the line or keeps an employee from returning to their important work (because dealing with a customer who is signing a contract isn't important) and then an average consumer tries to read the contract and gets socially slapped down for it, so he or she doesn't try to read contracts anymore.